non filing of income tax return notice under which section

Jewelry is valued at the market price whereas the valuation of the second house is. For filing defective return If you do not file the income tax return in the correct form you will receive a defective return notice from the income tax department.

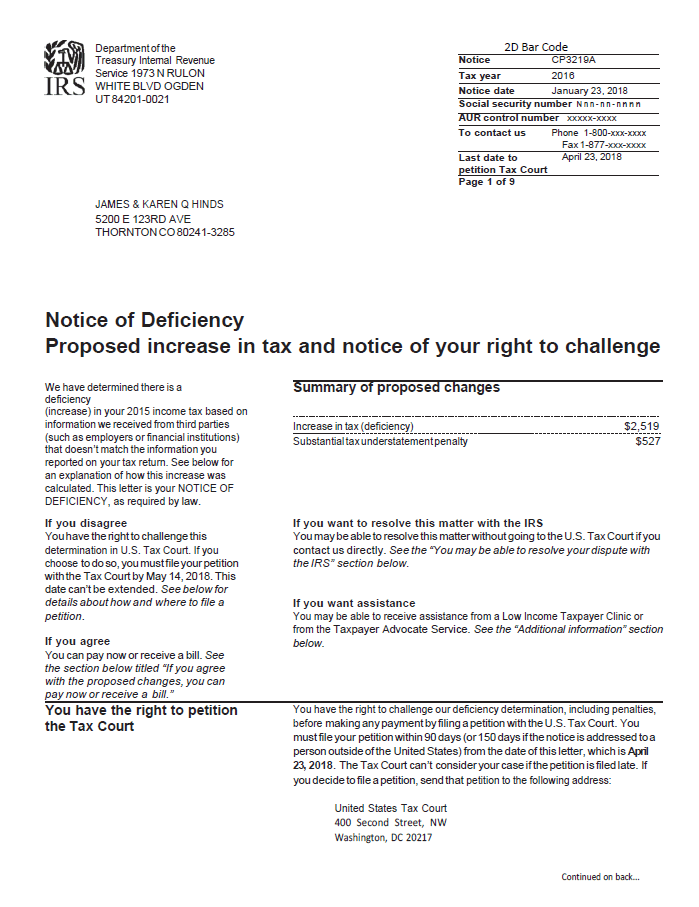

Notice Of Deficiency Overview Irs Forms Options

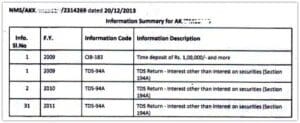

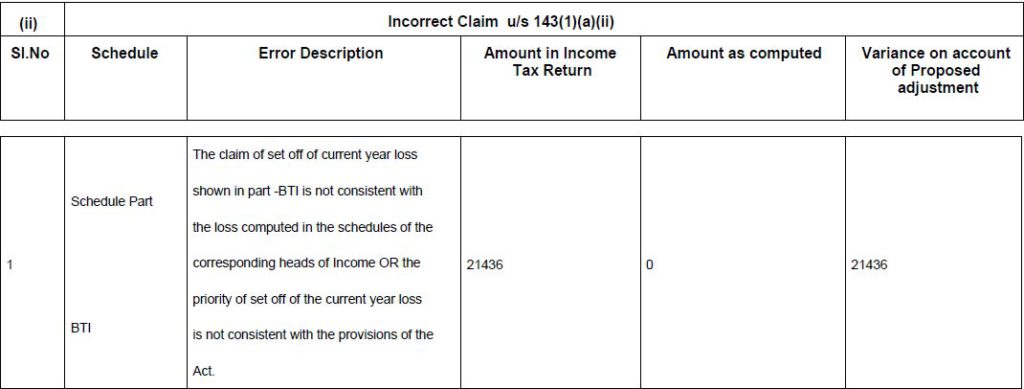

Income Tax Intimation Under Section 143 1 Learn By Quickolearn By Quicko How To Reply Notice For Non Filing Of Income Tax Return.

. In case of non-filing of return a notice under section 1421 is issued mentioning to file the return. Penalty for default in making payment of Self Assessment Tax As per section 140A1 any tax due after allowing credit for TDS advance tax etc along with interest and fee should be paid before filing the return of income. Since the return was beyond the time stipulated us 139 1 of the Act assessee was served with a notice us148.

You get a defective return notice under section 1399 of the Income Tax Act. Under e-Campaign Response on Filing of. Penalties leviable under the Income-tax Act.

The first home that individual holds is exempted from any tax. Click on e-file in response to notice us 139 9. Where tax sought to be evaded exceeds Rs 1 lakh 6 months to 7 years Rs 25 lakh wef.

7 Prosecution for Failure to Furnish Return of Income. Under this section the notice is sent to the tax payer to scrutinize the documents and accounts that they had submitted while filing the it returns. You may still receive a notice for non filing of ITR even if you were not required to file your ITR.

All groups and messages. 3 Non-Carry Forward of Losses. Tax paid as per section 140A1 is called self-assessment tax.

Upon successfully log in to the account click on the Compliance Tab. 2 Interest under Section 234A of Income Tax Act 1961. 5000 for missing the deadline.

Then select the option section 139 9 where there has been a mistake in the return filing. First and foremost Assessee has to file ITR online us 148 for the respective assessment year for which the notice is received. You may have to pay a penalty of up to Rs.

If you have a genuine explanation for not filing and if the officer is satisfied with the reason you may not have to pay the penalty. For filing the wealth tax valuation of the property needs to be done and for this help can be taken from government approved valuers. Under e-Campaign Non-Filing of Return click on Financial Year.

The Assessing Officer AO imposed penalty of Rs5000- us271F of the Act on the ground that the assessee failed to file his return of. It may be noted that in E- proceedings there is an option to file ITR us 148. Under this section details of non-filing of Income tax returns will be furnished.

1 Penalty under Section 271F of Income Tax Act 1961. The assessee need to address the tax notice and reply accordingly within specified time limits. Once received you need to respond to it within 15 days from the date of receiving the notice.

Failure to file the return of income as per section 1391. Failure to file the return of income in response to a notice issued under section 1421i or section 148 or section 153A. IRC 6651 a 1 imposes a penalty for failure to file a tax return by the date prescribed including extensions unless it is shown that the failure is due to reasonable cause and not due to willful neglect.

Willful failure to furnish return of income under section 1391 or in response to notice under section 1421i or section 148 or section 153A non-cognizable offence under section 279A can result into prosecution as under. Section 276CC provides for imprisonment in case of failure to file the return of income. How To Respond To Non Filing Of Income Tax Return Notice All About Notice U S 143 1 A And How To Deal With It Myitreturn Help Center.

6 Penalty for Concealment of Income. Income Tax Notice are in the form if intimation under section 1431 or proper Income Tax notice under section 1432 1421 148 or 245. An Income Tax Return is mandatorily required to be filed if the Total Income is more than the minimum amount which is exempted from the levy of tax.

Mail or Fax the Completed IRS Form 4506-T to the address or FAX number provided on page 2 of form 4506-T. Under the compliance tab click on View and Submit my Compliance option. If your gross total income before allowing any deductions under section 80C to 80U exceeds the basic exemption limits as prescribed by the Income Tax Department you have to mandatorily file your Income Tax Return for that Financial Year or Assessment Year.

Notice for Non-Payment of Self Assessment Tax. The issue under consideration is whether the penalty us 271f will be levied for non filing of income tax return itr even. Go to Compliance Compliance Portal.

Assessment order was passed us143 3 rws147 assessing total income at Rs4224116-. Under section 1421 the Assessing Officer can issue notice asking the taxpayer to file the return of income if he has not filed the return of income or to produce or cause to be produced such accounts or documents as he may require or to furnish in writing and verified in the prescribed manner information in such. Taxpayer who has received a notice for non-filing of the Income tax return through an SMS should take the following actions.

After filing the return the assessee must ask for a copy of reasons recorded for issuing of a notice under section 148 after which they are permitted to file an objection to the issuance of notice. Fill the reference acknowledgment number and fill the form with the correction. For the amount above Rs30 Lakh tax is levied at the rate of 1.

If the 4506-T information is successfully validated tax filers can expect to receive a paper IRS Verification of Nonfiling letter at the address provided on their request within 5 to 10 days. It may be noted that the entire proceeding for section 148 will be online now and hence so return would be required to be e-filed. Login to your account on incometaxindiaefilinggovin.

4 Best judgment assessment Assessment under section 144 5 Claim of Refund of Taxes. When a notice under section 148 is received the assessee is asked to file a return of the relevant assessment year. Income Tax Return Filing is one of the most important aspects of personal finance management.

See IRM 20123 Failure to File a Tax Return -. Furnish the appropriate reasons for not filling the Income Tax Returns. This article focuses on such cases wherein you may receive a notice for non-filing of ITR.

The income tax department may issue a notice under Section 271F for non-filing of IT Return. Submit the letter to the financial aid office. Section 276CC is attracted for any of the various defaults by the taxpayer.

How Should You Respond To A Defective Income Tax Return Notice Under 139 9

Irs Tax Notices Explained Landmark Tax Group

How To Respond To Non Filing Of Income Tax Return Notice

Non Filing Of Income Tax Returns Despite Earning Taxable Salary Kindly Refer To The Subject Noted Above 2 Section 1 Income Tax Return Income Tax Tax Return

25 6 1 Statute Of Limitations Processes And Procedures Internal Revenue Service

Don T Toss These 2 Important Stimulus And Child Tax Credit Letters From The Irs

How To Respond To Non Filing Of Income Tax Return Notice

How To Respond To Non Filing Of Income Tax Return Notice

How To Respond To Non Filing Of Income Tax Return Notice

How To Respond To Non Filing Of Income Tax Return Notice

Irs Audit Letter Cp2501 Sample 1

How To Respond To Non Filing Of Income Tax Return Notice

20 1 9 International Penalties Internal Revenue Service

What Is A Cp05 Letter From The Irs And What Should I Do

How To Respond To Non Filing Of Income Tax Return Notice

It Notice For Proposed Adjustment U S 143 1 A Learn By Quickolearn By Quicko

Irs Notice Cp80 The Irs Hasn T Received Your Tax Return H R Block

3 11 3 Individual Income Tax Returns Internal Revenue Service

All About Notice U S 143 1 A And How To Deal With It Myitreturn Help Center